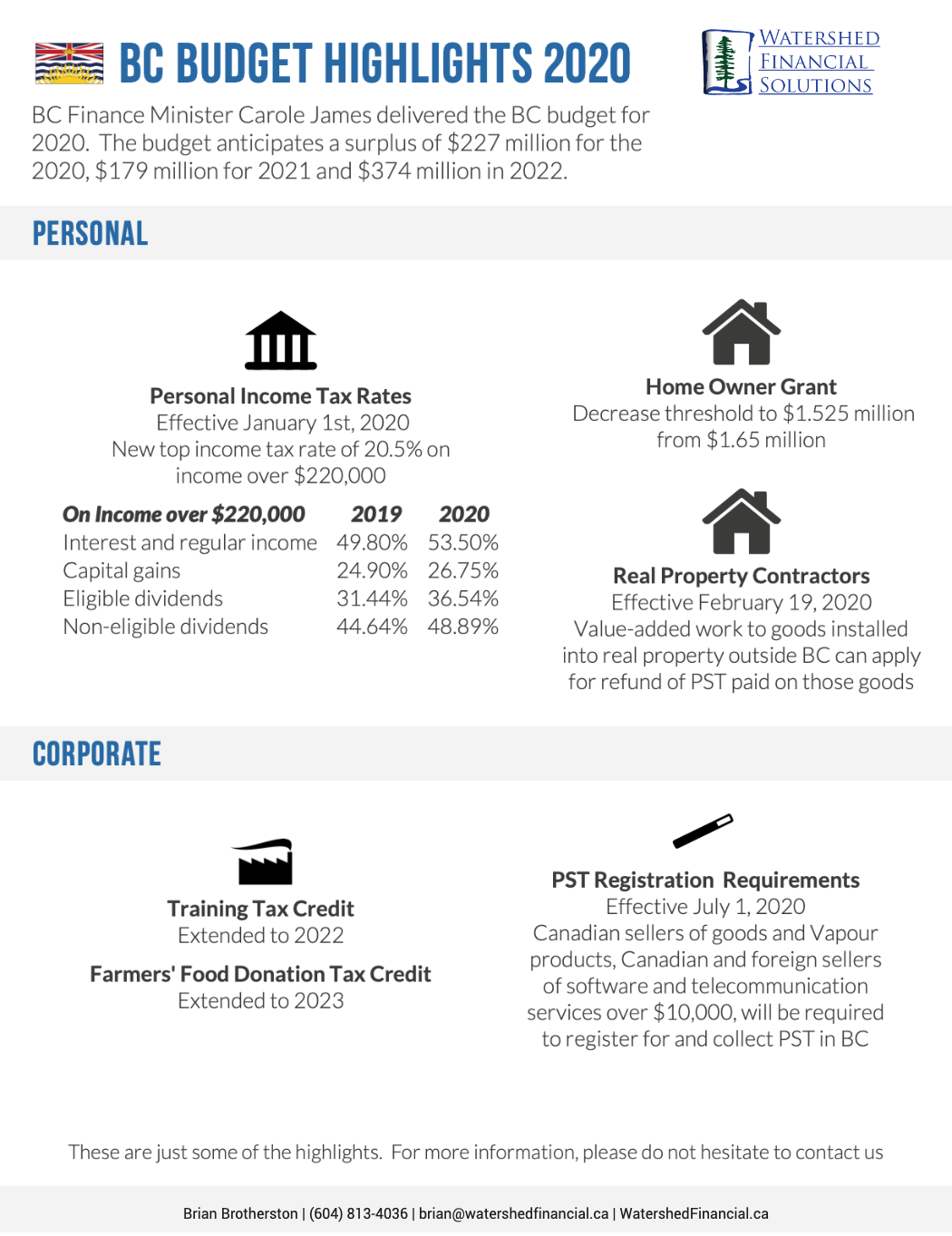

BC’s Finance Minister Carole James delivered the province’s 2020 budget on

February 18, 2020. The budget projects:

-

For 2020, a surplus of $227 million

-

For 2021, a surplus of $179 million

-

For 2022, a surplus of $374 million

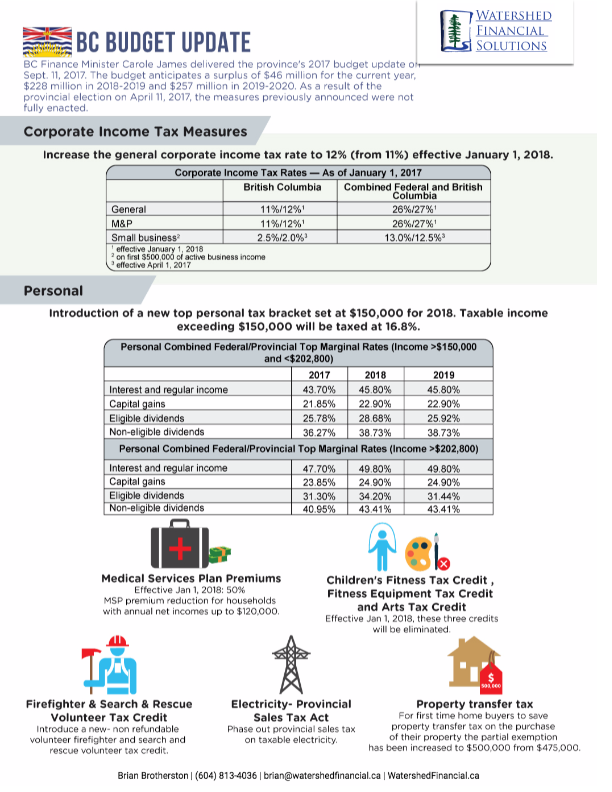

Personal Tax Changes

Personal income tax rates

Effective January 1, 2020, a new top British Columbia personal income tax rate of 20.5% (up from 16.8%) that will apply to individuals with taxable income exceeding $220,000. As a result, the charitable donation tax credit will also increase to 20.5% for charitable donations over $200 for taxpayers in the new bracket.

Home Owner Grant

BC will decrease the threshold for the phase-out of the home owner grant from $1.65 million to $1.525 million. For properties above the threshold, the grant is reduced by $5 for every $1,000 of assessed value in excess of the threshold.

Real property contractors

Effective February 19, 2020, the budget allows real property contractors who perform value-added work to goods and then install those goods into real property outside the province to apply for refunds of PST paid on those goods.

Training Tax Credit

Extended to the end of 2022

Farmers’ Food Donation Tax Credit

Extended to the end of 2023

Corporate Tax Changes

Film Incentive BC and production services tax credit

Effective February 19, 2020, the budget increases the accreditation certificate fee for the Production Services Tax Credit from $5,500 to $10,000.

Production Services Tax Credit Pre-Certification Notification Introduced

Effective July 1, 2020, corporations intending to claim the production services tax credit

must notify the certifying authority of their intent within 60 days of first incurring an

expenditure eligible for the tax credit.

Training Tax Credit

Extended to the end of 2022

Farmers’ Food Donation Tax Credit

Extended to the end of 2023

New Mine Allowance

Effective date to be specified, extended to the end of 2025

PST Registration Requirement

Effective July 1, 2020, Canadian sellers of goods, along with Canadian and foreign sellers of software and telecommunication services will be required to register as tax collectors if specified B.C. revenues exceed $10,000. Additionally, all Canadian sellers of vapour products will be required to register if they

cause vapour products to be delivered to B.C. consumers.

Sales Tax Changes

Carbonated Beverages

Effective July 1, 2020, carbonated beverages that contain sugar, natural sweeteners or artificial sweeteners will no longer qualify for the PST exemption for food products. PST will also apply to beverages that are dispensed through soda fountains, soda guns or similar equipment, along with

all beverages dispensed through vending machines (except vending machines wholly

dedicated to dispensing beverages other than sweetened carbonated beverages, e.g., coffee

or water machines)

Carbon Tax Rates Aligned with Federal Carbon Pricing Backstop Rates

Effective April 1, 2020, the B.C. carbon tax rates for 2020 and 2021 are aligned with

the federal carbon pricing backstop methodology, where applicable. As part of this

alignment, the current B.C. rates for shredded and whole tires are also being replaced

with a new category for “combustible waste”. Combustible waste includes tires in

any form, asphalt shingles as a new taxable combustible and any prescribed material,

substance or thing.

B.C. carbon tax rates are being updated to ensure they are in line with the latest science

on emissions. The previous rates were set in 2008 and are today considered to be based

on old science. For some fuel types, the rates are lower than their original scheduled rates.

For example, the tax rate for gasoline will be 9.96 cents per litre on April 1, 2020, rather

than 10.01 cents per litre. For some fuel types, the rates are higher than their original

scheduled rates. For example, the tax rate for natural gas will be 8.82 cents per cubic

metre on April 1, 2020, rather than 8.55 cents per cubic metre. The new rates will be

available on the Ministry of Finance’s website.

The B.C. carbon tax rates will be reviewed as part of the federal government’s review of

the Pan-Canadian Framework on Clean Growth and Climate Change in 2022.

Tax Rate for Heated Tobacco Products Introduced

Effective April 1, 2020, a default tax of 29.5 cents per heated tobacco product is

introduced. For specific heated tobacco products, this default can be changed by

regulation. A heated tobacco product is a product that contains tobacco and is designed

to be heated, but not combusted, in a tobacco heating unit to produce a vapour for

inhalation.

Property Transfer Tax

Exemption from Additional Property Transfer Tax for Certain Canadian-Controlled

Limited Partnerships Introduced

Effective on a date to be specified by regulation, a new exemption from additional

property transfer tax will be introduced for qualifying Canadian-controlled limited

partnerships. This exemption will treat Canadian-controlled limited partnerships in a

manner more consistent with Canadian-controlled corporations. It will ensure that new

housing developments are treated similarly irrespective of whether the development is

being undertaken by a Canadian-controlled corporation or Canadian-controlled limited

partnership.

The entire BC Budget can be found at https://www.bcbudget.gov.bc.ca/2020/downloads.htm#gotoNewsReleases